Tax Rates

Crooked River Ranch Rural Fire Protection District (dba Crooked River Ranch Fire & Rescue) is organized as a Special District under ORS 478. The District is governed by an elected five-member Board. The District is funded by a permanent tax rate, a voter-approved operations levy, and a general obligation bond for the specific purpose of the construction of the current fire station. The District's permanent tax was set by Measure 50 and based on the 1995 tax rates. This rate cannot be changed. The current 5-year Operating Levy was approved by the voters and took effect July 1, 2019. The District has had an Operating Levy approved by the voters since 2004. The voters approved the General Obligation Bond and it took effect in 2007.

- Permanent Tax Rate: $1.8379 per $1,000 of assessed value

- Local Option Levy (Operations) 7/1/2019 through 6/30/2024: $0.89 per $1,000 of assessed value

- General Obligation Bond approved by voters in 2007

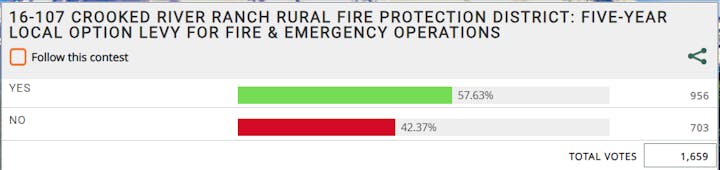

In November of 2023, voters approved a Local Option Levy to replace the current one that expires 6/30/2024. The approved Local Option Levy was approved at a rate of $1.17 per $1,000 of assessed value for five years (7/1/2024 through 6/30/2029). Click the linked content below for more information on the Local Option Levy.